[Free Template] Burning Bright: Mastering Your Online Business's Burn Rate for Financial Success

Are you a passionate online entrepreneur just starting your business adventure? As you enter the world of online opportunities, it’s crucial to navigate the financial tides confidently.

But what if your income streams are still new? Don’t worry! Even in the early stages, understanding your burn rate is fundamental for setting a solid financial course.

Let’s demystify the concept of burn rate and empower you with the knowledge to calculate and optimize it. Together, we’ll embark on a journey to chart a course towards financial success, no matter the size of your initial income waves.

Unveiling the Mystery: What Does Burn Rate Mean for Your Business?

Imagine your business as a high-performance vehicle racing towards your goals.

The burn rate is the fuel consumption rate—the rate at which you consume cash or resources over a specific period.

It’s the lifeline of your online enterprise, especially for startups, small businesses, and visionary solo-entrepreneurs like yourself.

So, what’s your burn rate, and how does it impact your financial journey?

Free TemplateCracking the Code: The Components of Burn Rate Calculation

Let’s break down the calculation process and explore the fundamental elements that make up the burn rate formula. Understanding its core components gives you insight into your business’s financial trajectory.

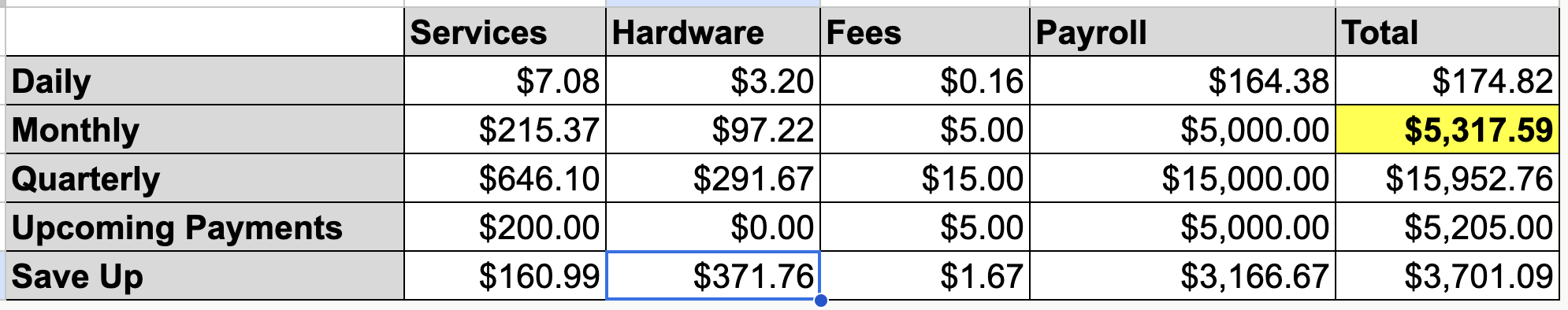

Firstly, consider your monthly or yearly expenses. These encompass costs necessary for running your online business smoothly, including salaries, rent, utilities, marketing expenditures, and potential one-time investments in hardware like laptops and work phones. Accounting for all these expenses helps you assess the financial fuel your business consumes each month.

Next, focus on the cash on hand, representing the available funds at the beginning of the chosen period. This includes money in your business accounts, savings allocated for business purposes, and potential investments or loans contributing to your financial resources. Knowing your starting point allows you to gauge the distance you can cover before your resources are depleted.

Lastly, consider the timeframe over which you want to calculate the burn rate. Whether you choose monthly or quarterly measurements, determining the duration allows you to monitor and evaluate your financial performance consistently. It provides context for tracking changes in your burn rate over time and identifying trends that impact your business’s financial stability.

By understanding these key components—monthly expenses, cash on hand, and timeframe—you possess the building blocks for accurately calculating your burn rate. Now, let’s put this knowledge into action and guide you through the step-by-step process of calculating your burn rate to unlock valuable insights for your business’s financial health.

Master Your Burn Rate: Let’s Crunch the Numbers!

Get ready to unleash the power of technology! Access the provided Google Sheets template to ignite your burn rate calculations:

Click this button to copy the template.(If you don’t have a Google account, you can still view it here.)

Show Me the Money: Documenting Your Recurring Charges

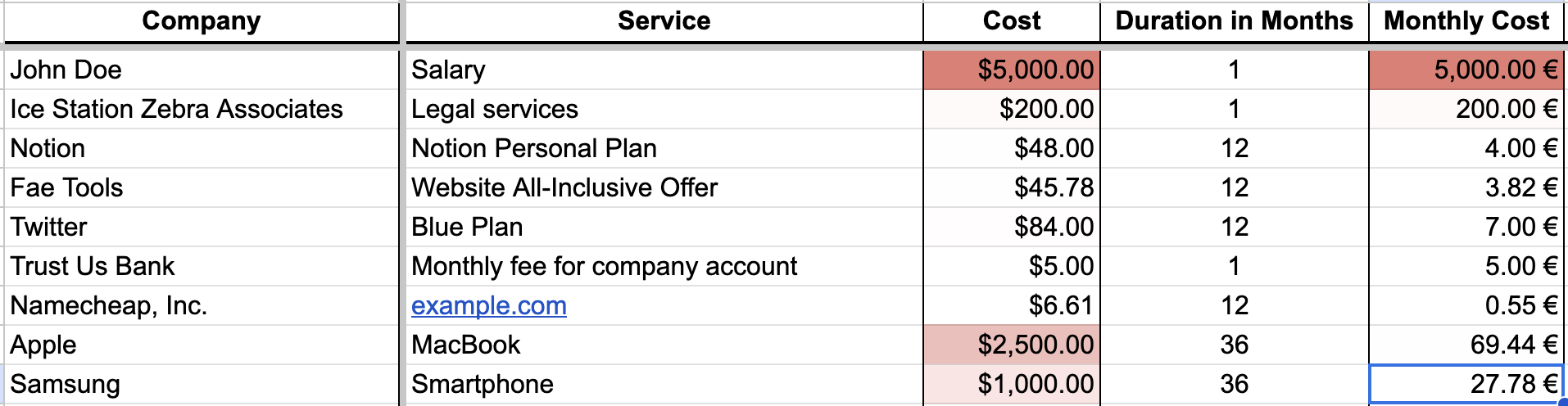

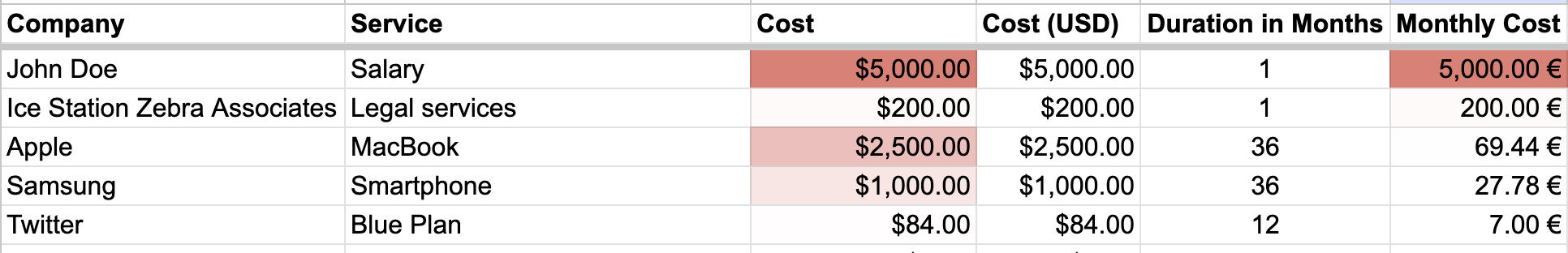

To calculate your burn rate, go to the ‘Recurring Charges’ sheet in the Google Sheets template. This sheet helps you list your business expenses and automates calculations for your convenience.

Here are the steps:

- List Your Charges:

Enter the service provider and the service they offer in the respective columns. Input the cost in your preferred currency column. The “Cost” column will automatically calculate the total cost. - Determine Start Date and Duration:

Choose a start date for the charges in the past. This allows accurate tracking of each expense’s duration. For monthly charges, enter “1” in the “Duration in Months” column. For annual charges, input “12” for a year. Don’t forget to include any hardware purchases and their expected duration. For instance, if you bought a laptop, enter its price and “36” in the “Duration in Months” column if you expect it to last for three years at a similar price. This way, the sheet calculates the monthly cost of the item. - Mark Recurring Costs and Automatic Recurrence:

Check the boxes for “Recurring Cost” and “Recurs Automatically” if applicable. Most service providers automatically charge your credit card for recurring expenses. By marking “Recurs Automatically,” you create a reminder for yourself. The sheet provides information on when the next charge is scheduled. - Saving for Future Payments:

Plan for future expenses using the sheet. It calculates the amount you need to save for the next payment. For example, if you have a laptop listed as a recurring charge, you can start setting aside small amounts for the next laptop purchase. This ensures you’re financially prepared when the time comes. - Categorize Your Charges:

Categorize each charge by selecting a type from the dropdown menu. Common categories include “Payroll,” “Service,” “Fee,” or “Hardware.” This helps organize your expenses and provides insights into your burn rate composition. You can also leave notes for additional context or reminders.

By using the “Recurring Charges” sheet in the Google Sheets template, you can easily track and calculate your recurring expenses, gaining a comprehensive understanding of your burn rate.

Now that you have a solid foundation, let’s explore additional features and calculations within the template to gain deeper insights into your business’s financial health. It’s time to delve into the exciting world of financial analysis! 😉

The Burn-o-Meter: Visualizing Your Gross Burn Rate Snapshot

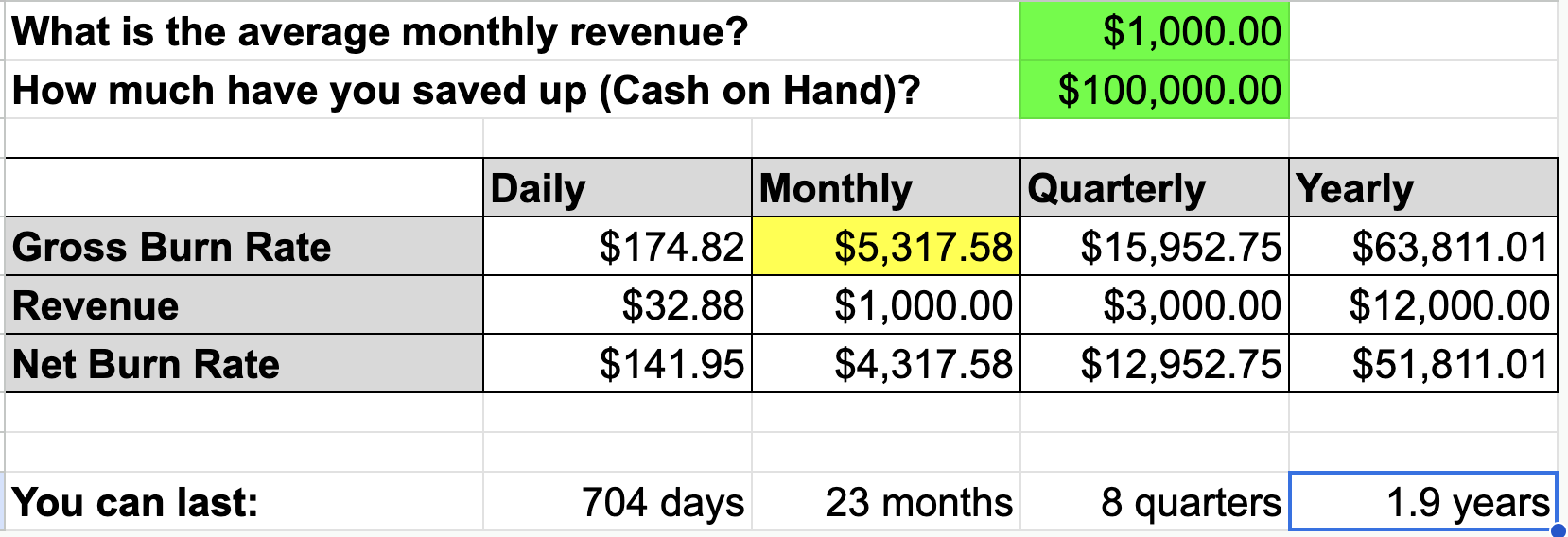

After inputting your recurring charges and relevant details, let’s explore the “Gross Burn Rate” spreadsheet in the Google Sheets template.

This powerful tool provides a comprehensive overview of your burn rate, empowering informed financial decisions.

Let’s dive into its features:

- Gross Burn Rate per Category:

The spreadsheet displays the burn rate for each charge category. It sums up expenses within each category, giving you insights into how different types of expenses contribute to your overall burn rate. - Total Gross Burn Rate:

Additionally, the spreadsheet provides the total gross burn rate by summing up all expenses across categories. This represents the total amount of resources your business consumes over a specific period, giving you an understanding of the scale of your financial outflow. - Daily, Monthly, and Quarterly Burn Rate:

The spreadsheet presents the burn rate in different time intervals: daily, monthly, and quarterly. These values help you track your expenditure over shorter-term periods and make comparisons over different time frames. Monitoring these rates allows you to assess spending patterns and evaluate your business’s financial sustainability. - Upcoming Payments and Savings Suggestions:

To assist with financial planning, the spreadsheet shows the total amount of upcoming payments within the next 30 days. This gives you valuable insight into your short-term financial obligations, enabling effective cash flow management.

The template also suggests how much you should save for future payments based on your listed recurring charges. This serves as a guide to help you allocate funds and ensure you have enough resources for upcoming expenses.

By utilizing the “Gross Burn Rate” spreadsheet, you gain a clear understanding of your burn rate at different intervals and receive actionable insights for financial planning.

Let’s move on to the next subsection and uncover how to precisely calculate your business’s time frame. Get ready to unleash a new level of financial clarity as we unveil the key to mapping your business’s future. It’s time to unlock strategic planning and make financial decisions with confidence.

Financial Endurance: Unveiling Your Business’s Lifespan with Net Burn Rate

Now, let’s explore the “Net Burn Rate” spreadsheet in the Google Sheets template.

This tool provides insights into your financial health, considering average monthly revenue and cash on hand.

Let’s dive into its functionalities:

- Average Monthly Revenue:

Input your average monthly revenue in the “Net Burn Rate” spreadsheet. This represents the income generated by your online business each month. By entering this information, the spreadsheet calculates the net burn rate based on your revenue and expenses. - Cash on Hand:

Next, input the amount of cash on hand available to your business at the start of the calculation period. This includes your business accounts, savings, and any investments or loans contributing to your financial resources. Accurately entering this information ensures the net burn rate calculation reflects your starting financial position. - Net Burn Rate Calculation:

The spreadsheet calculates your net burn rate for different time frames: daily, monthly, quarterly, and yearly. It considers your average monthly revenue and deducts your expenses to determine the net amount of cash your business consumes over each period. This provides a more accurate reflection of your financial position by considering the revenue offsetting your expenses. - Time Remaining:

One of the valuable features of the “Net Burn Rate” spreadsheet is its ability to estimate how much time you have left based on your current revenue and expenses. It calculates the remaining time in days, months, and years. This information helps you gauge the sustainability of your business and understand how long your savings would last if your revenue remains constant. It serves as a crucial indicator for financial planning and decision-making.

By utilizing the “Net Burn Rate” spreadsheet, you gain a comprehensive understanding of your financial situation, considering both revenue and expenses. This empowers you to make informed decisions and proactively manage your business’s financial health.

Let’s move on to the next subsection to explore additional functionalities within the template and further optimize your burn rate analysis. Get ready to take your financial analysis to the next level!

Explore, Enhance, Excel: Unleashing Additional Functionality

The Google Sheets template provides three additional sheets for enhanced functionality and convenience.

Let’s take a quick look at these sheets:

- Upcoming Payments:

The “Upcoming Payments” sheet displays all payments due within the next 30 days, based on your recurring charges. It’s your go-to reminder to stay on top of financial obligations and manage cash flow effectively. - Sorted Charges:

The “Sorted Charges” sheet offers an overview of all your listed charges, sorted by their monthly costs. It helps you identify the expenses that have the greatest impact on your business’s finances. Knowing the relative costs allows you to prioritize budgeting and expenditure decisions. - Configuration:

The “Configuration” sheet allows you to set the currencies used within the template. It’s essential to configure the desired currencies at the beginning for accurate calculations. While currency conversion is handled automatically, remember to adjust the number formatting manually for clarity and consistency.

By utilizing these additional sheets, you can conveniently track upcoming payments, understand the impact of charges based on monthly costs, and configure currencies to suit your needs. These features enhance the usability and adaptability of the template, streamlining your financial analysis and decision-making process.

With a comprehensive understanding of the template’s functionalities, you’re now ready to calculate your burn rate accurately, analyze your financial health, and make informed decisions for the success of your online business. Get ready to take control of your finances and thrive!

Harnessing Burn Rate Wizardry: Financial Decision-Making

Calculating and monitoring your burn rate using the Google Sheets template brings valuable benefits for online entrepreneurs like you.

By harnessing the power of burn rate analysis, you can make informed financial decisions, optimize your budgeting, and ensure the long-term sustainability of your online venture.

Let’s explore the key benefits for solo entrepreneurs:

- Financial Clarity and Planning:

As an online entrepreneur, understanding your financial health is crucial. Calculating your burn rate provides insights into your cash or resource consumption rate. It helps you assess monthly expenses, from software subscriptions to marketing costs and utilities. Gaining financial clarity allows effective budget planning, expense tracking, and informed decision-making to maximize your business potential. - Resource Optimization and Growth:

Knowing your burn rate empowers you to optimize resources and drive growth. Analyzing charges and costs within the Google Sheets template helps identify areas for cost-cutting or finding more cost-effective alternatives. Prioritizing spending and investing in high-return resources ensures efficient allocation for sustainable growth. - Strategic Decision-Making:

Monitoring burn rate supports strategic decision-making aligned with business goals and available resources. Accurate financial insights help evaluate new opportunities, assess expansion plans’ impact, and prioritize initiatives within your financial capabilities. Leveraging burn rate analysis avoids financial pitfalls and drives your online business forward. - Financial Communication and Investor Confidence:

For entrepreneurs seeking funding or partnerships, understanding and communicating burn rate is crucial. Demonstrating financial acumen and a clear grasp of your business’s financial position builds confidence in potential investors or partners. Burn rate analysis enables transparent discussions about revenue, expenses, and runway, securing the support needed to scale your online business.

By harnessing the benefits of the Google Sheets template and diligently calculating your burn rate, you gain valuable insights into your financial position as an entrepreneur.

This knowledge empowers you to make informed decisions, optimize resource allocation, and confidently navigate the online business landscape.

It ensures that you can focus on creating value, serving your customers, and achieving your dreams with financial stability and sustainability.

Turbocharge Your Business: Strategies to Propel You Forward

To maximize the effectiveness of your burn rate analysis and propel your online business forward, implement strategies that optimize your financial performance.

By employing the following strategies, fine-tune your burn rate, increase revenue, and achieve sustainable growth.

Let’s explore these powerful tactics:

- Cost-Cutting Measures:

Identify areas to reduce expenses without compromising quality. Scrutinize recurring charges, negotiate better deals, and explore cost-effective alternatives. Consolidate software subscriptions, optimize your marketing budget, and streamline operational processes. Every saved dollar extends your runway and enhances financial stability. - Revenue Generation Techniques:

Boost revenue streams through innovation. Diversify offerings to reach new markets. Leverage digital marketing to expand online presence and drive sales. Explore partnerships, collaborations, or affiliate marketing. Focus on revenue generation to offset expenses and improve your burn rate. - Efficient Resource Allocation:

Optimize resource allocation for maximum impact. Align team skills with value-generating tasks. Automate repetitive processes (we’d love to help you with this) using technology. Leverage outsourcing or freelancers. Strategically deploy resources to achieve more with less, positively impacting burn rate and business performance. - Continuous Monitoring and Analysis:

- Regularly track and analyze burn rate. Identify trends and patterns. Assess the impact of changes in revenue, expenses, or investments over time. Make data-driven decisions, course-correct, and seize optimization opportunities. Stay vigilant, responsive, and drive long-term success.

Remember, optimizing burn rate is an ongoing process. Constantly evaluate and adjust. Implement these strategies to optimize financial performance, extend runway, and position your business for sustained growth.

Concluding Your Financial Journey: Conquer Burn Rate and Accelerate Your Online Business!

With the tools and knowledge to calculate your burn rate, accelerate your online business towards financial success.

Take the driver’s seat, monitor burn rate, and optimize finances with precision. Fuel your dreams and dominate the online business landscape.

Let the Google Sheets template be your trusted co-pilot on this thrilling journey. Shift into high gear, make data-driven decisions, and ignite the world with your financial prowess.

The road to online business triumph awaits—rev up and conquer the digital realm!

Free Template